A new proposal making its way through the U.S. House of Representatives’ Ways and Means Committee would significantly increase taxes on tobacco products if passed.

In an effort to fund the Biden Administration’s proposed Build Back Better American Rescue Plan, members of the Ways and Means Committee are working to find a way to fund the plan, which will cost an estimated $3.5 trillion. Paying for the plan through increased taxes is no surprise, though placing the burden on tobacco businesses has many in the tobacco industry very concerned. The committee sees a potential $96 billion that could come from hiking the taxes of tobacco products. This will be done through various ways including doubling the taxes on all cigars, adding more taxes to pipe and roll-your-own tobacco products, and levying new taxes on e-cigarette products. This proposed tax hike doesn’t exempt premium cigars–they too would see a dramatic increase in the price of doing business.

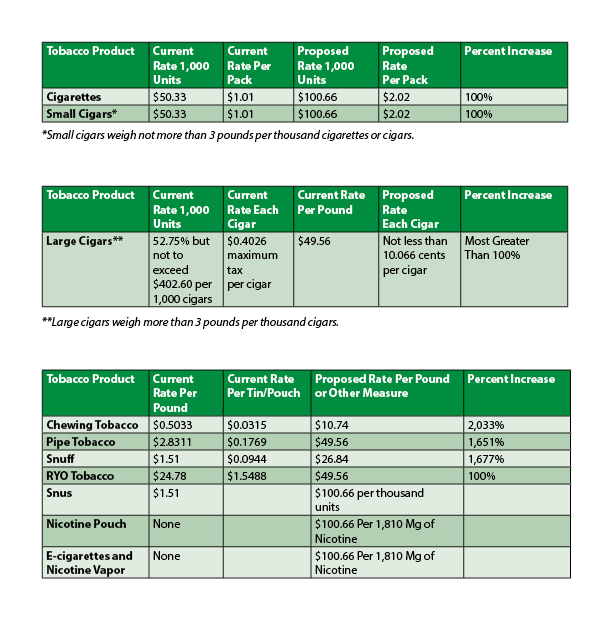

Here are the proposed cigarette, tobacco, and vapor tax rates from the U.S. House Ways and Means Committee: