24

TOBACCO BUSINESS INTERNATIONAL

SEPTEMBER/OCTOBER 2015

Combustible Renaissance?

The overall combustible cigarette environment remains robust, according

to a recent survey by Wells Fargo.

R

etailers expect cigarette sales

to be slightly up, according

to Wells Fargo’s most recent

Tobacco Talk survey, which polled 30,000

retailers about sales trends. Among

other things, retailers suggested that the

growth could be attributed to consumers

disillusioned by e-cigarettes switching

back to combustibles.

Retailers also noted that the competitive

environment remains stable in the

aftermath of the mega-merger between

R.J.Reynolds(RJR)andLorillard,withmost

respondents describing the industry as in

a “holding pattern” since the restructuring

impact from the deal remains to be seen.

However, the retail industry does expect

change as the two companies integrate.

As one retailer noted, “I think we’ll see

some brand switching since Winston and

Kool will become visible again. Obviously

RJR and Altria will react to any aggressive

push on pricing from ITG, so the consumer

may be the winner. If the gap becomes

too narrow, discount brands will be under

pressure.”

Another noted, “Once the dust settles,

believe it will be difficult for ITG to gain

traction. Believe Altria and the new RJRT

will move on to many fronts for ITG

to keep up in many areas. ITG’s cigar

brands continue to lose ground. Believe

the losses in cigars will come more from

Swisher and SMNA than from JMC.”

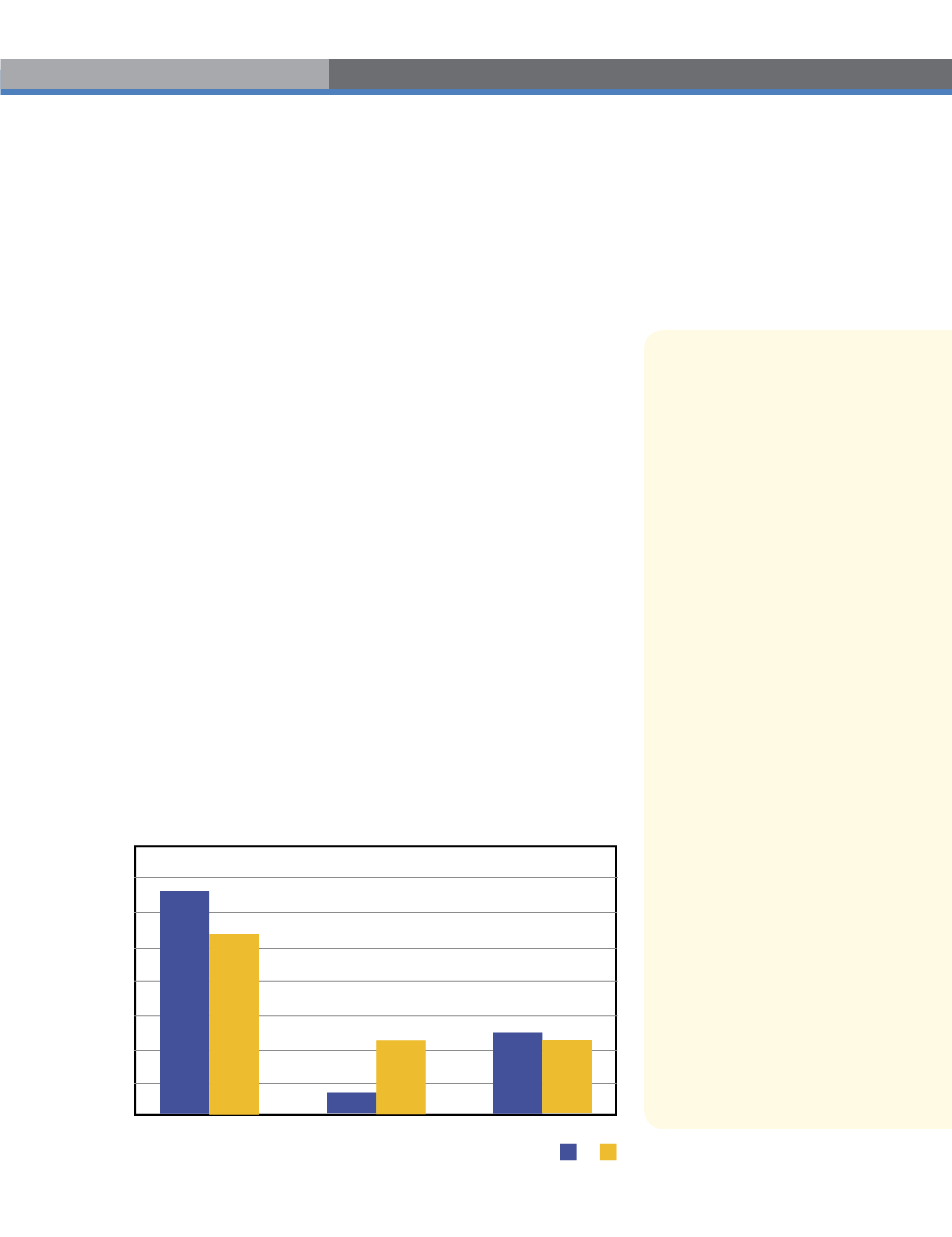

In the smokeless category, retailers

reported that volume is continuing to

decelerate as more consumers are

“uptrading” to combustible cigarettes

or switching to other noncombustible

options. While consumers are continuing

to switch to vaping, that category’s

growth rate has slowed, and analysts

expect dampened growth to continue

unless technology improves.

The tables and charts to follow offer

more details on these industry trends.

Industry overview

CATEGORY MANAGER

60%

50%

40%

30%

20%

10%

0%

Retailers Assess Smokeless Tobacco Category Volume Growth

(Quarter/Quarter)

70%

80%

Increased

Decreased

Stayed the same

67%

54.3%

8%

22.9% 26% 22.9%

Q2

2015

Q1

2015

Wells Fargo asked retailers to comment

on how the Reynolds-Lorillard merger

and the current tax environment will

impact the industry. The following are a

sampling of responses.

“The

RAI/LO

merger

and

consolidation has given the Top 2

tremendous influence over pricing.”

“States have already taken tax hikes,

and [there are] probably more to come.

As taxes increase erratically, I believe

it reduces the manufacturers’ pricing

power.”

“They are getting to the tipping point

and any economic downturn will drive

consumers to the lower-tiered product,

whether that is OTP or e-cig/vape.”

“States like Indiana and Tennessee

have both made recent changes to their

minimum cigarette retail laws. Effective

July 1, Indiana moved the minimum

retail markup from 10 percent to 12

percent. Tennessee minimum retails

moved from 8 percent to 11 percent.

Tennessee minimum retails will take

additional increases to 13 percent and

15 percent on July 1 2016, and 2017,

respectively. This blunts the effect of the

Marlboro MLP.”

View

from the

Retail

Front Lines