VENDOR PROFILE

such a wide net is cast. They had to do

that because of political pressure, but they

also knew that these regulations would

be progressively reduced and narrowed

down by litigation. FDA is used to that; it

is a way for them to operate.”

However, even if the hoped-for chang-

es come, many of the smaller manu-

facturers and vapor retailers will still

be unable to survive the winnowing of

the field. In fact, a significant number of

manufacturers are already “dumping”

products in an effort to exit the market—

and for good reason. Both paths to FDA

approval, substantial equivalence and

the pre-market tobacco applications,

will be expensive and time-consuming.

Still, there are also plenty of competitors

that hope to stay the course. “Everyone

who intends to continue to be a player

in this market was launching products

in advance of the August 8 deadline,” he

says. “I’ve seen some interesting stuff

that I wasn’t expecting.”

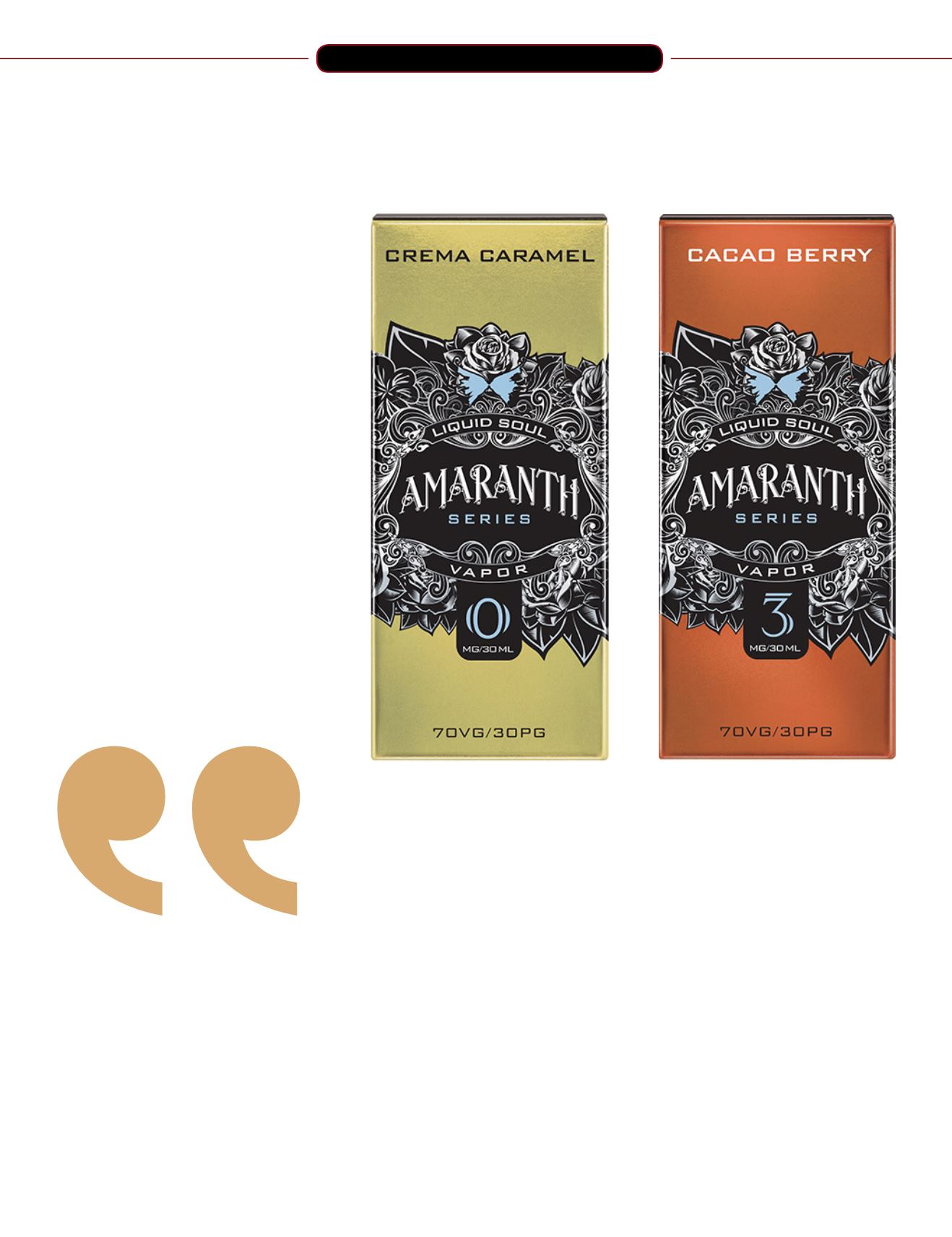

AN EXPANDING LINEUP

EAS is also expanding its offerings. The

company recently introduced Liquid Soul

Amaranth, a premium liquid brand made

with HydraVape MAX technology, a pro-

prietary process that uses tobacco-free

nicotine (TFN). Named for the Amaranth

flower, a blossom known to the Ancient

Greeks as “the flower that never fades,”

Amaranth was designed to produce a

consistent vape at any standard tempera-

ture, delivering powerful long-lasting fla-

vors with minimal vape tongue.

“Everyone who

intends to continue

to be a player in

this market was

launching products

in advance of the

August 8 deadline.

I’ve seen some

interesting stuff

that I wasn’t

expecting.”

82

TOBACCO BUSINESS INTERNATIONAL

SEPTEMBER/OCTOBER 2016