40

TOBACCO BUSINESS INTERNATIONAL

SEPTEMBER/OCTOBER 2016

also to help create blends of tobacco for

fellow stogie manufacturers without pre-

predicate products.

“I get teased for releasing a lot of

blends,” states Rocky Patel, founder of

Rocky Patel Cigars. But that turned out

to be an industry blessing this past July

when Patel’s factories were in full produc-

tion until 1 a.m., churning out 1,470 new

SKUs, according to the cigar great. “We

plan on complying with the rules, but of

course we’re hoping to defeat this some-

how. Churning out those SKUs was our

insurance policy looking forward,” he says.

It was also to help out smaller and

boutique manufacturers that didn’t have

any pre-predicate products—those that

didn’t come on the cigar scene until 2009,

2010 and 2011, for example. “I remember

when I started, I didn’t have a lot of help,

but these times are very tough. I feel for

them; they’re getting punished for trying

to make a great cigar, so we’re trying to

give them as many blends as we

can.We’re

helping them with this launch,” says Patel.

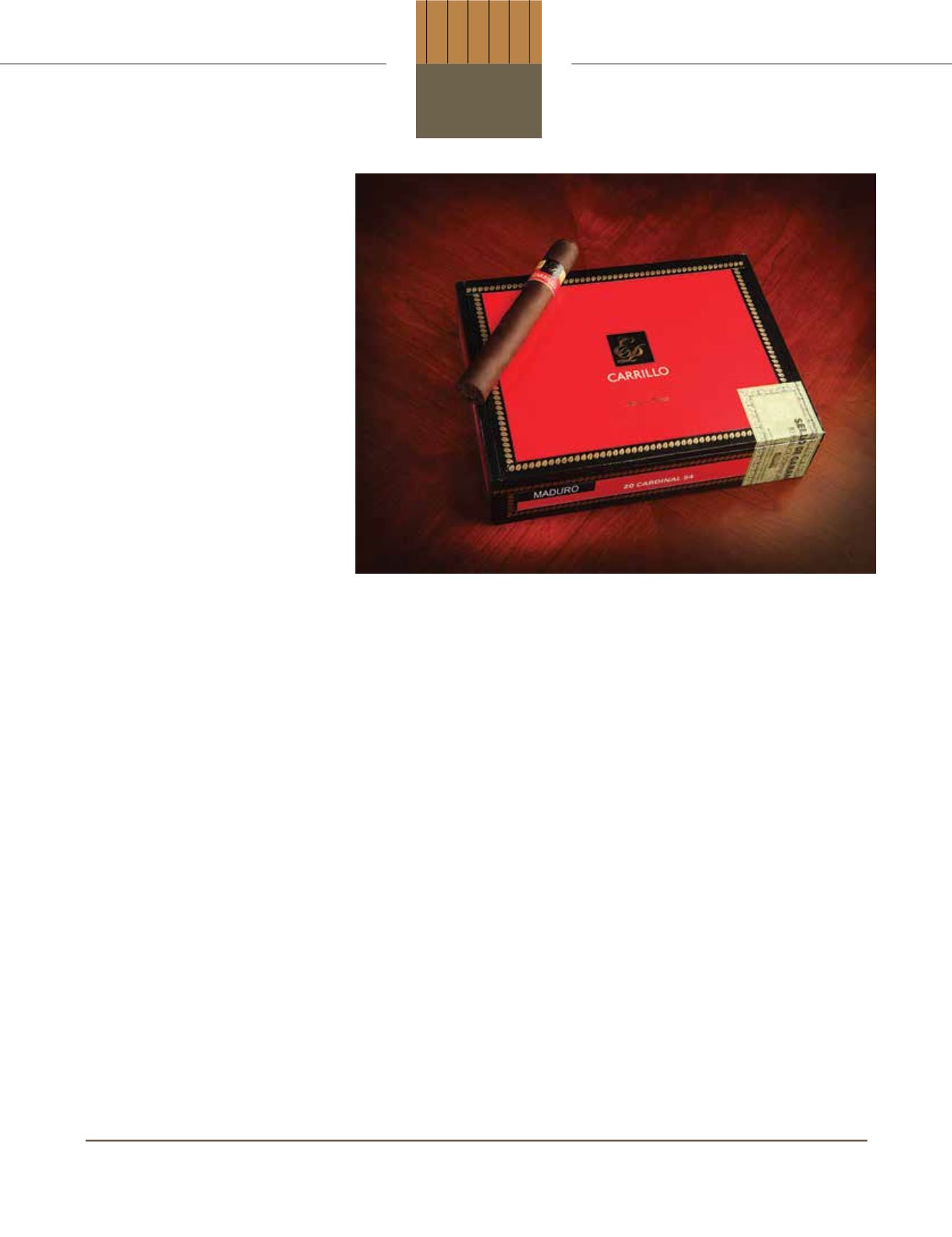

One of these smaller players is EPC

Cigar, makers of La Gloria Cubana ci-

gars. “We started in 2009, so there’s not

a lot to fall back on,” admits Ernesto Per-

ez-Carrillo, referring to the fact that his

company does not have a pre-predicate

product. “But as a company, we are going

to be investing and fighting this thing out.

Right now, it’s business as usual, and down

the road we will see what happens. We’ve

seen so many things in this industry; we’ll

adapt and find a way to roll forward. I’m

very optimistic.”

Meanwhile, there are others in the in-

dustry—in between a Rocky Patel and

La Gloria Cubana pre-predicate product

wise—who are just as optimistic. “As op-

posed to Rocky, I only came out with 14

new SKUs before August 8, not 1,400,

but I was still lucky to have pre-predicate

product[s],” says Pete Johnson of Tatu-

aje Cigars. “I am confident I have enough

product in my portfolio to get an SE on—I

have a lot of

brands.Wehave great lawyers

and I plan to get old in this business.”

The “Trimming of Brands”

Conversation

One of the consequences of regulation is

that cigar makers are being forced to scale

back on products now and in the near fu-

ture, knowing that they won’t be able to

“save” many SKUs.

“When I look at my portfolio, it’s going

to be about trimming products that might

not make sense moving forward,” Johnson

says. “I can’t hold on to inventory for per-

sonal reasons, no matter how much I want

to—it doesn’t make economic sense, not

when we’re talking about $100,000 to reg-

ister one SKU. At this point, I don’t know

what the exact cost will be. No one has told

us anything yet along those lines, but I know

the trimming is coming.”

“Absolutely, lines will go away for us,”

agrees Patel. “We have to keep what sells.

There are sizes we love, but we have to nar-

row that portfolio.” As an aside, he reveals

that “we took down all our blends from

our websites; we want to keep it as vague

as possible. All we want to say is that it’s

tobacco. The worst thing now would be to

list country of

origin.Wewant to keep it as

broad as possible, but we already lost a lot

of brands.”

From where Perez-Carrillo sits, “we’re

a new company and all four of our lines

will have to be changed and blended with

more predicate date blends—I will prob-

ably be knocking on Rocky Patel’s doors

for that,” he says.

The “FDA Failings”

Conversation

The way Patel sees it, “The FDA has not

learned about our business; they’ve not

spent time to learn it. It is so different

C I GAR SENSE

Unless regulations change, relatively new boutique companies will

need to reblend their products to incorporate predicate date blends.