56

TOBACCO OUTLET BUSINESS

MAY/JUNE 2013

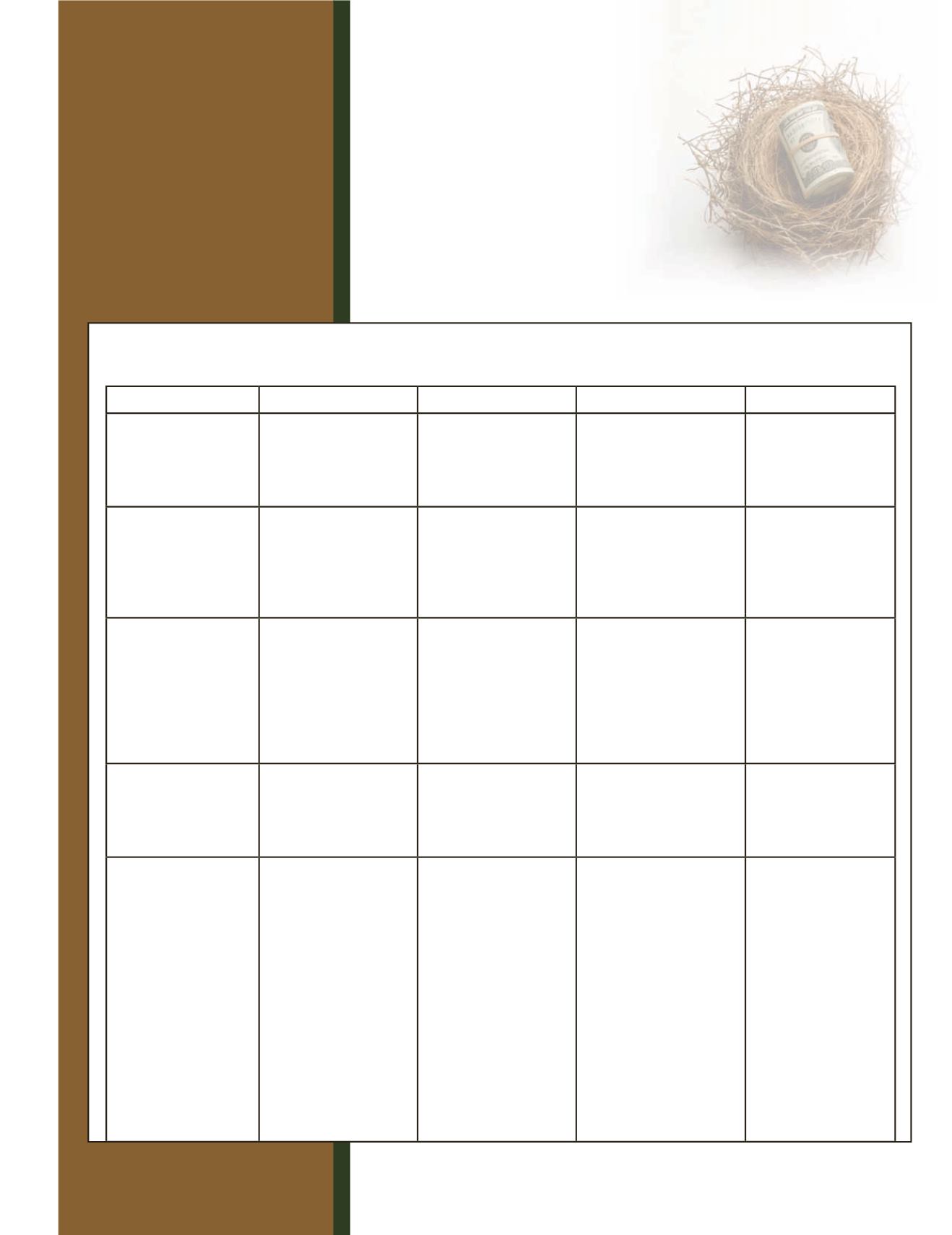

In Focus: RetIRement

How Popular Retirement Plan Options Stack Up

SEP

SIMPLE IRA

Profit Sharing (Keogh) Individual 401(k)

Key Advantage

Easy to set up and

maintain

Easily established with

minimal IRS reporting

requirements

Permits employer to

make large

contributions for

employees

Permits business

owners with no

salaried employees

to make large

contributions

Employer Eligibility

Any employer with

one or more employees

Any employer

with 100 or fewer

employees that does

not currently maintain

another retirement

plan

Any employer with one

or more employees

Any sole proprietor

and his or her spouse

who works in the

business

Employer’s Role

May use IRS Form

5305-SEP

to set up the plan.

No annual filing

requirement for

employer

May use IRS Forms

5304-SIMPLE

or 5305-SIMPLE to

set up the plan. No

annual filing

requirement for

employer

May need advice from

a financial institution or

employee benefit adviser.

Must file annual Form

5500

A one-participant

401(k) plan is

generally required to

file an annual report

on Form 5500-SF

if it has $250,000 or

more in assets at the

end of the year

Contributors

to the Plan

Employer

contributions only

Employee salary

reduction

contributions and

employer

contributions

Annual employer

contribution is

discretionary

Both business

owner and company

contributions are

discretionary

Maximum Annual

Contribution

(per participant)

Up to 25 percent of

compensation

but no more than

$50,000 for

2012 and $51,000 for

2013

Employee:

$12,000 in 2013.

Participants age

50 or over can make

additional

contributions up to

$2,500;

Employer: either

match employee

contributions

or contribute

2 percent of each

eligible employee’s

compensation

Up to the lesser of

100 percent of

compensation 1 or

$51,000 for 2013.

Employer can deduct

amounts that do not

exceed 25 percent

of aggregate

compensation for all

participants

Business owner:

100 percent of

compensation up to

IRS limit for 2013 of

$17,500 ($23,000 if

age 50 or over);

Company

Contribution:

25 percent of

compensation as

defined by the plan.

Total combined

contributions not to

exceed $51,000 in

2013

56

TOBACCO OUTLET BUSINESS

MAY/JUNE 2013