come to me with their personal issues; they

consider this business their family.”

And as much as employees respect Hoyt, he

respects and puts a lot of faith in them. “We’re

big on [being a] team here. It’s very much a

family, and we let each of our store managers

have control,” he says. “If a hurricane comes,

it’s ‘Do what you have to do.’ If they don’t feel

safe, they can close the store—they are in con-

trol. We trust them. It’s like we have a supervi-

sor at every one of our stores.”

Even on product matters, Hoyt admits a

manager may make a better call than he. “They

know our business. I go in and tell them that I

think we’re overstocked; and they’ll tell me that

that’s not the case. I’ve been here 15 years, but

some of them have been here longer—the lon-

gest is 35 years, and we have a handful that have

been here 20 years. [So] I listen to them.”

THE “C” WORD

But there is one area where employees and

Hoyt clash: the idea of bringing this business

over to the “C” word—cannabis. The state of

Louisiana recently legalized the sale of medi-

cal marijuana and, as an ever-evolving entre-

preneur, Hoyt can’t not look at the business

potential in cannabis accessories and more. But

he also can’t ignore the culture clash that it rep-

resents—something employees have been more

than candid about.

“Part of the issue is that we run a company

where we drug test—we built a team around

being drug-free, so we find ourselves in a di-

lemma,” Hoyt tells

TB

. “We didn’t do anything

around synthetic [marijuana] a couple of waves

back when the state [legalized] it. As a fami-

ly-run Christian business and with my dad in

politics, that was an easy call. But now that it

passed in medical and seems to be where the

industry seems to be evolving, we don’t want to

miss out. We’re evaluating it week by week.”

He emphasizes that, naturally, none of the

products he’s evaluating for sale in his potential

non-medical marijuana stores contain THC.

Instead, they are glassware and CBD (

cannabi-

diol

) items.

Nevertheless, because a few veteran man-

agers and employees told Hoyt that he has to

choose between “these products or me,” he’s

taking a cautious approach. Where managers

are willing, he has put in some alternative items

to see how well they do with present Smoke ’N

Go customers.

So far, they’re not really moving. “Maybe

we’ve already abandoned that customer,” says

Hoyt. “It’s like going into McDonald’s and ask-

ing for a hot dog. It doesn’t work.”

Hoyt already had an inkling of that when he

tested vape products a few years ago. “We didn’t

want to get into vapor, but when the nail salon

on the side of one of our stores put out a sign

saying ‘We carry electronic cigarettes,’ we got

into it by default.”

Quickly, Hoyt learned that the drive-thru

was a handicap to vape, just as it seems to be

for alternative items. “All we have is one face

behind the window. We don’t have time to ed-

ucate, nor the time to show them product be-

cause the queue is four to five cars deep—but

that’s what’s working for us in the combustible

tobacco business.”

And when something is working with the

business, “My dad has always told me to leave it

alone,” says Hoyt.

So now the question becomes “Does Smoke

’N Go stay intact and open a sister store across

the street?” as Hoyt puts it. A store that has a

“touchy-feely” aspect for vape items and alter-

natives? One that does not have a dress code,

but rather, lets employees “walk the talk and

look the part?” This is Hoyt’s present thinking.

“We’ve built our business model around com-

bustibles and now that’s changing, so let’s keep

these 21 [products] up and running. There’s no

reason to stop that,” he comments. “However, as

products expand, so must our retail concepts.”

LOYALTY PROGRAMS AND MORE

That doesn’t mean the Smoke ’N Go loca-

tions will stop evolving as well, notes Hoyt,

who is currently gathering knowledge on loy-

alty programs.

“My theory is that no new smokers are enter-

ing the market,” he says. “They’re already shop-

ping my local c-store competitors. My plan is to

have a loyalty program to go to war against my

competition and have those customers shop my

stores.” Hoyt hasn’t worked out the loyalty pro-

gram details yet, but he recognizes that it needs

to be “drum tight.”

Last year, the chain invested in a FasTrax

POS system and began scanning items at the

register. “What drove that improvement is the

new Philip Morris contract, where if you send

them scan data they’ll offset the cost of it,” says

Hoyt. “That has been huge for small mom-and-

pops like us. It funded us to get into the 21

st

cen-

tury, system-wise.”

Hoyt and his father also recently took a road

trip to visit other tobacco stores to network and

explore ancillary ideas such as growler beers,

fountain drinks and local business partnerships.

Since he climbed aboard his father’s retail

tobacco legacy, “Go” might as well be Hoyt’s

middle name, as he has kept the business mov-

ing in an evolutionary direction. And he doesn’t

plan on stopping now.

TB

Smoke ’N Go

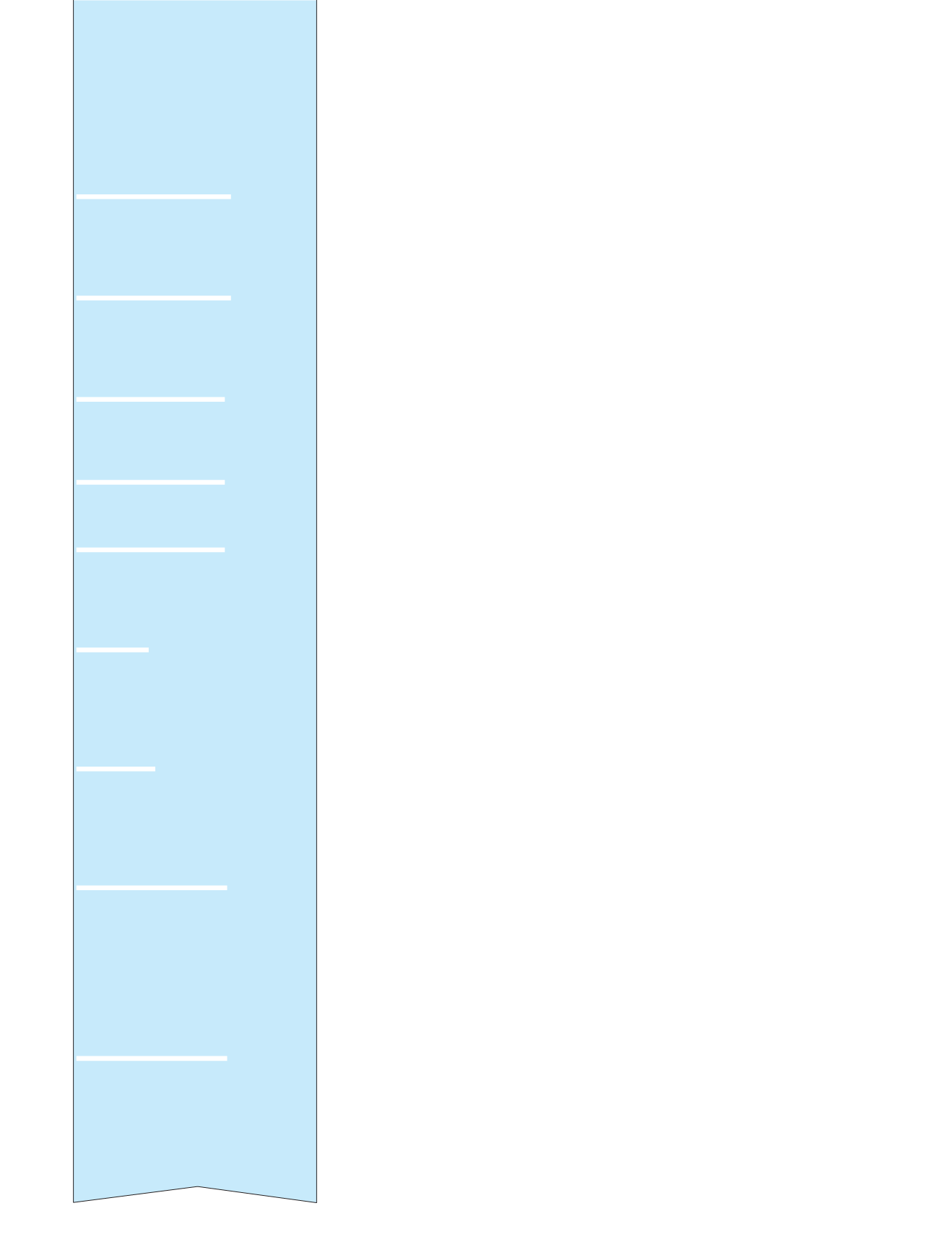

Timeline

1991:

Fred Hoyt opens Cheap-O-Depot

tobacco outlet; it is the second

tobacco store in the state

of Louisiana.

1993:

Four more Cheap-O-Depot stores

open, officially classifying the

company as a tobacco

outlet chain.

2000:

Two acquisitions bring the total

Cheap-O-Depot locations

up to seven.

2002:

Richard Hoyt, Fred’s son,

joins the family business.

2003:

Father and son open up the first

Smoke ’N Go concept, for

a total of eight stores.

The drive-thru era is born.

2004-2010:

The chain’s growth goes into its

highest gear. New stores are

opened and competitor stores

are bought out at the rate

of two stores a year.

2011-2014:

Cheap-O-Depot locations are

morphed into the new Smoke ’N

Go concept, by either updating

or moving locations to

accommodate a drive-thru.

2015:

The 21st Smoke ’N Go location is

acquired. From the chain’s main

office in Abbeville, Louisiana, stores

“are about two hours [away] in

every direction,” says Richard Hoyt,

vice president. “Within our radius,

the market is saturated. That is our

reason for slower growth.”

2017:

The chain is currently looking to buy

out a current competitor or two.

It is also “sitting on ‘Go’ for new

opportunities,” says Hoyt. These

include a possible separate business

model for alternative items.

[ T O B A C C O B U S I N E S S . C O M ]

TOBACCO BUSINESS

[ 17 ]