26

TOBACCO BUSINESS INTERNATIONAL

MAY/JUNE 2015

Mergers and

Market Share

In the cigarette category, a large merger is edging toward fruition.

W

ith the Reynolds American/

Lorillard merger looming on

the horizon, there’s much

speculation about how the deal will pan

out in terms of shifts in the competitive

landscape. While the deal awaits final

regulatory approval, industry observers

are optimistic about its future, with

Wells Fargo’s Bonnie Herzog rating the

probability of Federal Trade Commission

(FTC) approval at 90 percent.

“An overwhelming 98 percent of

retailers expect the FTC to approve

the deal, with some retailers expecting

minor modifications or additional brand

divestitures since several believe it will

be challenging for Imperial to maintain

share,” wrote Herzog in a recent report

on the merger, who notes that the biggest

potential issue has been whether Imperial

and some of the smaller manufacturers

will be able to effectively compete

with the newly created entity. “Despite

this hurdle, we believe…negotiations

are progressing towards ultimate FTC

approval of the deal as is or with very

minor modifications to ensure Imperial

will have a fighting chance.”

One key consideration by FTC of

relevance to retailers is the potential

impact of Reynolds adding Newport to

its Every Day Low Price (EDLP) retailer

program on shelf space constraints for

Imperial. “The majority of our retailer

contacts do not expect the FTC to require

changes to Reynolds’ EDLP for the deal

to be approved and expect Newport’s

growth will accelerate if added to this

program,” notes Herzog.

Currently, the deal calls for Winston-

Salem, North Carolina-based Reynolds

American to purchase Greensboro, North

Carolina-based Lorillard for $27.4 billion.

The combined entity would retain the

Newport, True and Old Gold brands,

while selling Winston, Kool, Salem and

Maverick brands to Imperial Tobacco for

$7.1 billion. The real coup for Imperial,

however, would be acquiring Lorillard’s

blu e-cigarette brand. Imperial would

also acquire Lorillard’s manufacturing,

R&D and headquarters in the transaction,

which would become part of a new

U.S.-based subsidiary for the UK-based

company, located in Greensboro.

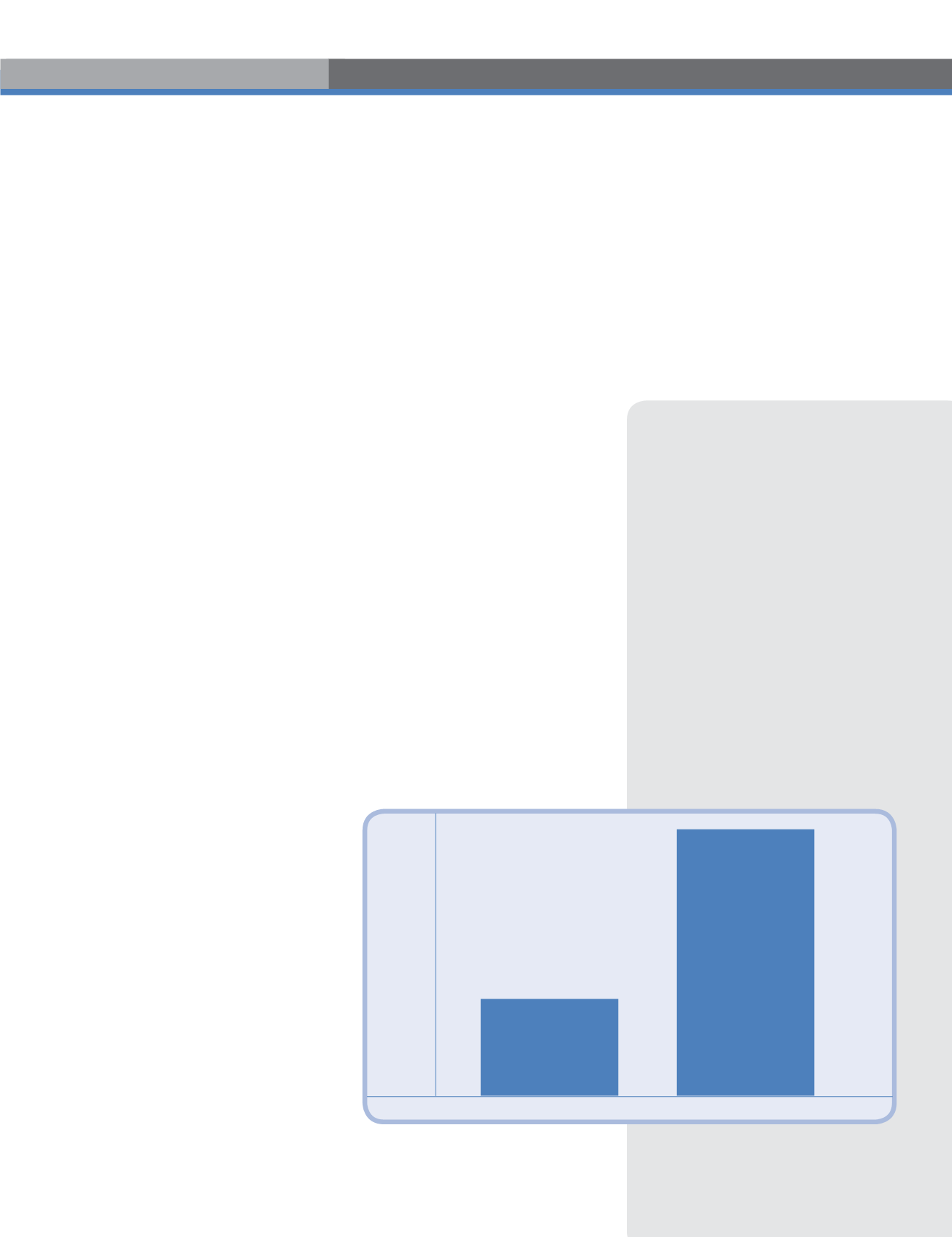

With business going on as usual while

the industry awaits a decision from FTC,

here’s a look at cigarette market share by

retail channel:

CIGARETTES

CATEGORY MANAGER

of retailers

believe

Reynolds’

EDLP program will

make it

more

difficult

for

Imperial to compete

post merger.

85%

45

40

35

30

25

20

15

10

5

1

Sticks Sold Over 13 Weeks Ending 6/28/14

Total Discount

Cigarettes Sold

(15 Billion)

Total Premium

Cigarettes Sold

(45

Billion

)

Premium Vs. Discount

Cigarettes

Number of Sticks Sold in Billions