38

TOBACCO BUSINESS INTERNATIONAL

MARCH/APRIL 2016

Cigarettes, Vapor and More

CATEGORY MANAGER

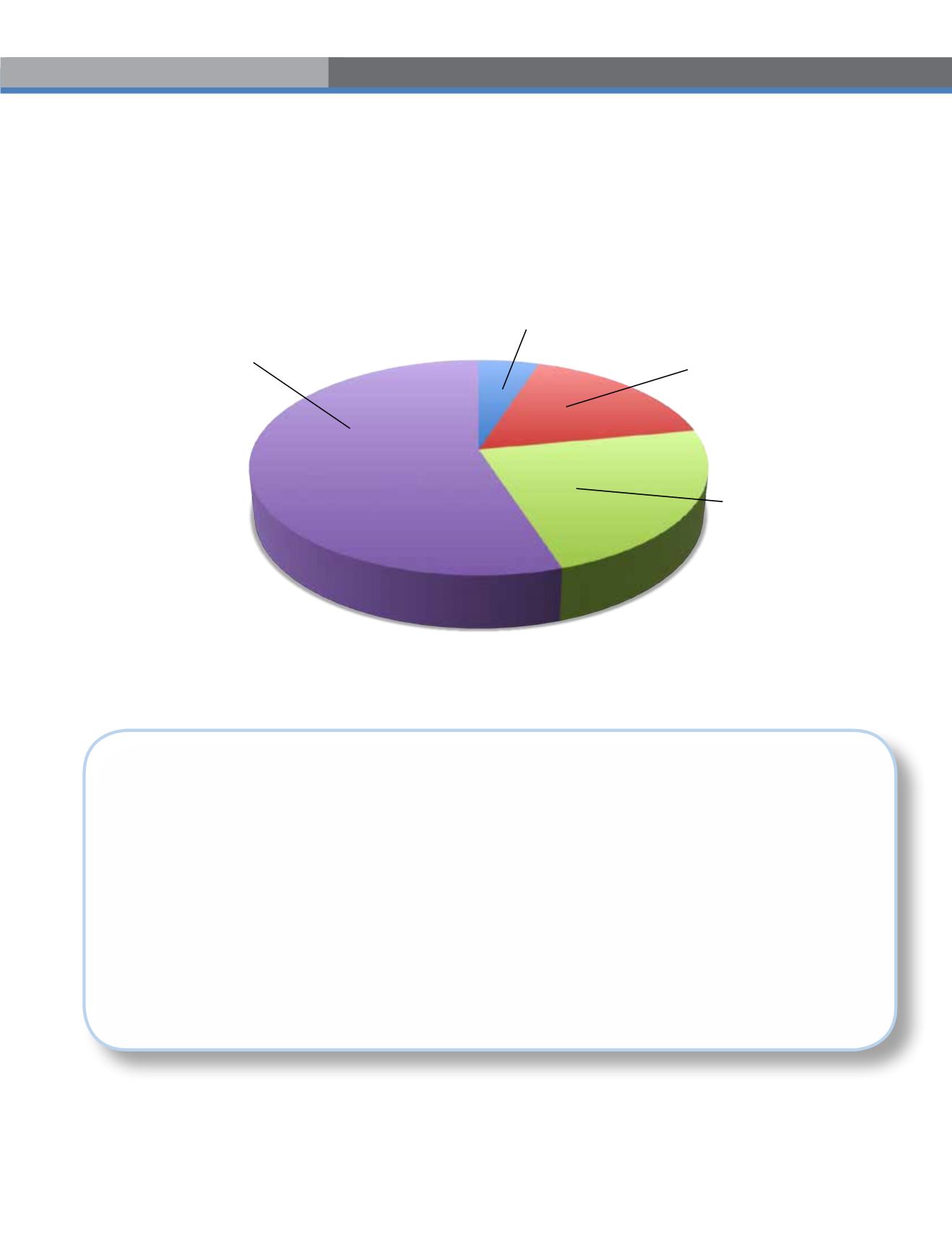

Vapor Market Breakdown by Sub-segment

(Sales mix for the 52 weeks ending January 23, 2016)

5%

Liquids

17%

Kits

23%

Disposables

55%

Rechargeable

Refills

Source: Wells Fargo Securities

Spotlight on the Vape Shop Channel

The vape shop channel remains a formidable competitor to tobacco outlets, according the 2015 Vape Shop Index,

a recent report released by ECigIntelligence, Roebling Research, E-Cigarette Forum and the Smoke-Free Alternatives

Trade Association (SFATA). The report, which analyzed financial, product and brand-level data from 540 vape shops

across 42 states, found that average monthly revenue per vape shop was $25,600.

However, both the vape shop channel and the vapor marketplace are still relatively fragmented. More than two-thirds

of respondents (69 percent) were single-store owners, while 16 percent owned two shops and just 15 percent had three

or more stores. The report noted that e-liquids account for the bulk of sales (60 percent) in vape shops, with fruit and

dessert flavors ranking as top-sellers. Asked to identify the top-selling products in their stores, respondents named a

total of 532 brands of e-liquid against just 52 brands of tanks and atomizers and 42 brands of mods, suggesting that no

one company has emerged as dominating in brand penetration.