I

t’s a deadly jungle out there. But

it’s also business as usual for those

vape players up to the industry

challenge of the next two years.

As of August 8, vapor products are

considered tobacco products and of-

ficially operate under FDA control.

Industry supporter Gregory Conley,

president of the American Vaping As-

sociation (AVA), called August 8 “the

beginning of a two-year countdown

to FDA prohibition of 99.9-percent-

plus of vapor products on the market.”

He says that “if we do not succeed in

changing the FDA’s arbitrary predicate

date of February 15, 2007, the vapor

industry will shrink to almost nothing

beginning August 8, 2018.”

And so the industry’s

Survivor

game is

underway, with the strongest contestants

fighting and strategizing for their future,

while at the same time looking to sustain

and grow their now-risky business.

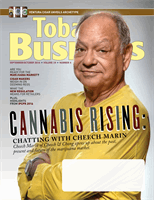

Mistic Aims for Mass Appeal

One of these “survivors in progress” is

Mistic E-Cigs, which had timing on

its side. Looking to appeal to the “mass

smoking population,” as well as the

vaping population, with an improved

experience/easier-to-use device, it re-

leased its 2.0 POD-MOD in late July

in advance of the FDA deeming rule

deadline (the concept was in the works

for months before the news of the final-

ized deeming regulations hit in May).

The system is akin to the popular K-cup

coffee machine experience; the Mistic

2.0 is a closed system with change-out

flavor pods.

The product “gives the experience,

flavor profiles and vapor production

that mod users are accustomed to, and

also provides ease-of-use to cig-alike

users who haven’t upgraded because

they didn’t want to deal with the hassle

of bottles and tanks,” explains Justin

Wiesehan, VP of marketing at Mistic.

However, it is the latter group that this

product is intentionally targeted to.

“In our sales data, cartridges are still

our best-selling items for four years; that

consumer is still out there, and they’re

not as in front of this industry as the

mod users,” says Wiesehan. “They’re not

on Instagram, they’re not going to vape

shows; that demographic is primarily in

the 45-70 age range and the majority of

them for us are women—all they want

to do is use Mistic instead of Marlboro,

and they don’t make a big fuss of it.”

He goes on to tell

Tobacco Business

International

that “everybody thinks

this industry is made up of hard-core

vapers who blow clouds and build big

old batteries and coils—that’s part of

the market, and it’s where the negative

hype unfortunately comes from. There’s

still a large part that just wants to stop

smoking. They use it and it works for

them, and they’re not out posting it on

Facebook or Twitter.” They’re also not

perpetuating the bad press—and Mistic

is looking to tap this largely untapped

market as quickly as possible.

With 9 million vapers in the U.S. and

45 million smokers, “we still haven’t

touched the surface yet,” Wiesehan

maintains. “If we can provide product

convenience that can help replace ciga-

rettes, that’s what we’re trying to go af-

Survivors

& Strategies Afoot

In the wake of the August FDA deadline, which essentially froze

industry innovation, strategy-minded vape players push forward with

survival tactics.

By Renée Covino

electric

ALLEY

62

TOBACCO BUSINESS INTERNATIONAL

SEPTEMBER/OCTOBER 2016