S

C

O

O

P

The Latest

56

TOBACCO BUSINESS INTERNAT

IONAL

MAY/JUNE 2014

completely different from moist snuff and long

cut. It’s sweet, it’s not as strong, and it’s overall

more attractive. I’m expecting it to do well now

with all the emphasis on alternatives.Customers

are ready and eager to try new things.”

In the tobacco outlet channel, leading

player Smoker Friendly puts credence in snus

growing for 2014, according to Jeremy Weiner,

marketing and purchasing director.

At Nothin’ Butt Smokes, snus hasn’t had a

great following so far,as stated by Vice President

Shon Ross, but he’s not discounting it—not at

all. “Snus has not taken off like people in the

industry imagined, but we still have a decent

section dedicated to it,” he explains. “We want

to make sure we try all of these alternatives in

small doses until they take off. We know it’s all

still playing out.”

Reduced- and

Modified-Risk Products

The future of the tobacco sector is paved with

reduced-risk products (RRPs), modified-risk

products (MRPs), next generation products

(NPGs), and overall tobacco harm reduction

(THR). All referring to the same group of

products, the day will likely come when one

wins out as the definitive designated acronym.

In the meantime, whatever you want to call this

emerging category, it clearly warrants research

and investment for both the short and long

term.

The

Wall Street Journal’

s Corporate

Intelligence blog recently reported that “coming

up with something new to sell is a matter of

existential importance” for major cigarette

companies “whose core product is in long-

term decline,” and who have been investing in

“reduced-risk products.”

Philip Morris International CEO André

Calantzopoulos said at a recent investor

conference that “reduced-risk products” are

“our greatest growth opportunity in the years

to come, which we believe has the very real

potential to transform the industry.”

RRPs continue to be Philip Morris’s “greatest

growth opportunity,” agrees Wells Fargo

Securities analyst Bonnie Herzog. She reports

that Philip Morris remains on track to launch

its Platform 1 RRP (HeatSticks) in two test

cities in the fourth quarter of this year, with

the first national launch set for 2015. Platform

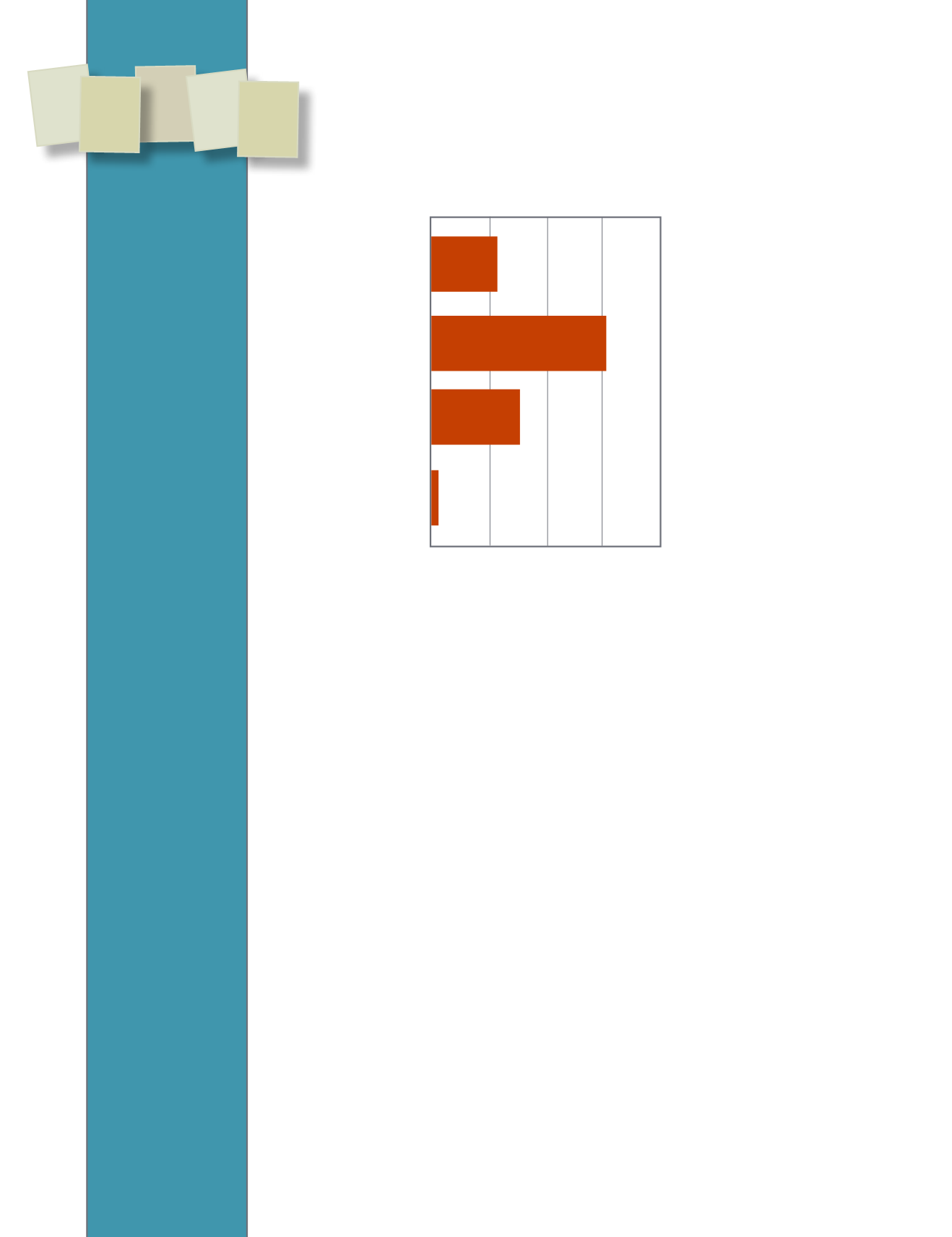

Moist Smokeless Can Growth

Total MST

Portion Pouch MST

Low Price MST

Premium MST

0% 5% 10% 15% 20%

While portion pouches are growing at

a faster rate, low price is contribut-

ing more in absolute bases (e.g., 64

percent of can growth) given its size.

However, portion pouches still drive

an impressive 33 percent of the can

growth. Two-thirds of portion pouch is

being driven by the low-price segment,

which is essentially flipped versus two

years ago.

SOURCE: BALVOR/CSNEWS RESEARCH