“We’ve had a good run,” says Nik Modi,

tobacco analyst for New York-based RBC

Capital Markets, reporting on cigarette

sales. “We have seen consumers trading

up to branded premiums and exiting the

e-cigarette category to go back to brand-

ed premium cigarettes, so it has been a

good 18 months for the industry.”

Noting that cigarette sales actually

increased slightly in the first quarter of

2016, Modi cautioned retailers not to

expect that trend to continue. “We are

starting to see wobbling of the data,” he

reports. “We expect cigarette volumes

to return to a -3 percent to -4 percent

annualized decline. If you think about it,

there has not been structural change as

to why consumers have been smoking

more. The only thing I can point to is

a return of consumer confidence where

we might be seeing more smoking per

smoker as people go out more.”

While combustible cigarettes are hav-

ing a relatively good run, e-cigarettes

are not faring as well, according to Modi,

whose research suggests that c-store

retailers in particular are losing enthusi-

asm for the vapor category. In fact, 95

percent of c-store retailers in a recent

survey reported that sales of open sys-

tems never really got started or are start-

ing to decline.

“I get a lot of criticism for being too

negative on e-cigarettes,” he notes.

“But I try to be a realist. The reality is

[that the category] will be big in the fu-

ture, but product efficacy is not where it

needs to be. The hard-core, pack-a-day

smoker needs a certain amount of nico-

tine and the e-cigarettes cannot deliver

that no matter what they tell you. The

R&D will get there, but who will invest

in it without more clarity on the regula-

tory climate?”

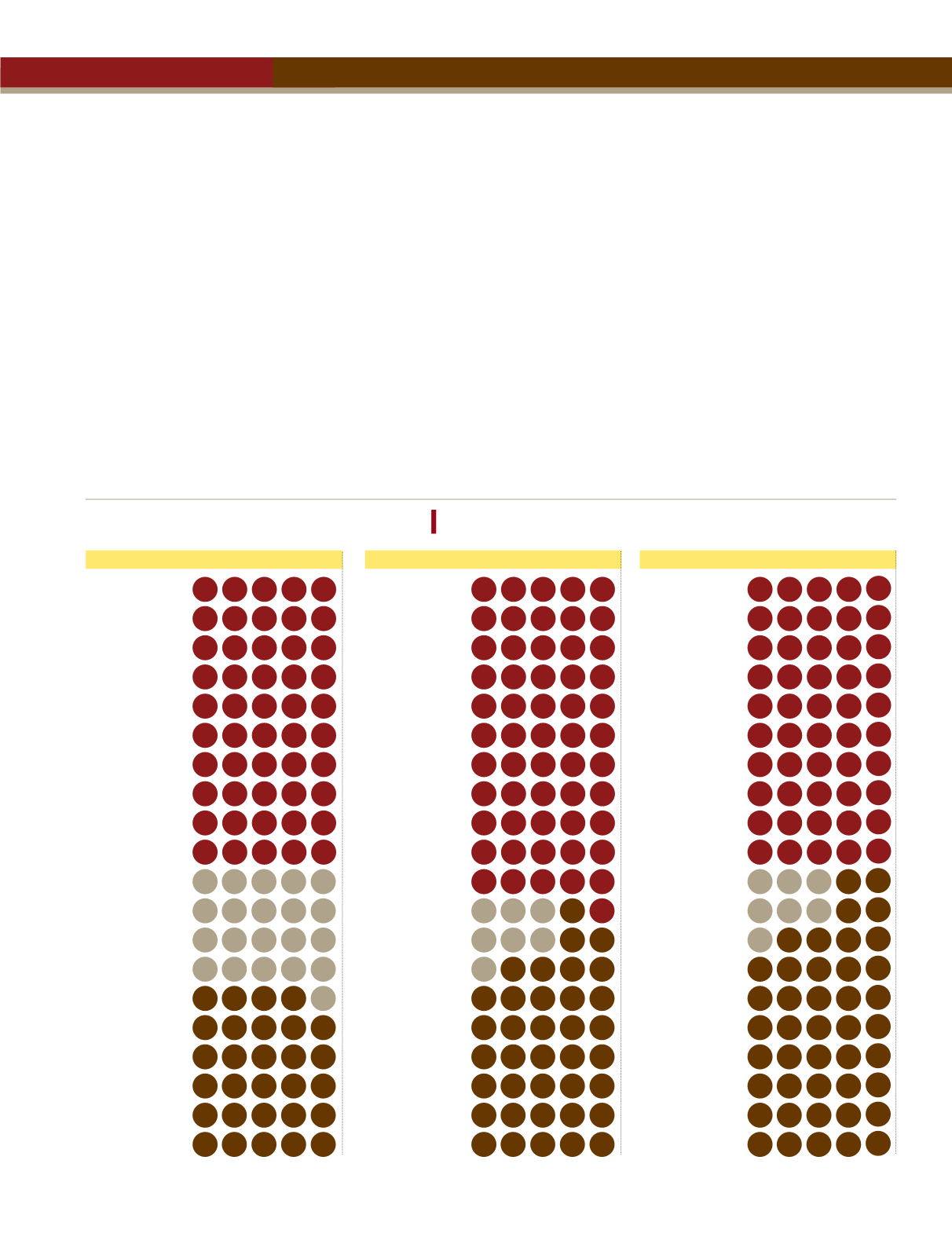

The charts on the pages to follow

offer a snapshot of some of Modi’s latest

research on the cigarette and vapor

categories.

With gas prices down and a stable economy,

consumers are returning to premium brands.

56%

37%

7%

Marlboro

Newport

Camel

50%

56%

21%

Marlboro

Newport

Camel

50%

43%

7%

Marlboro

Newport

Camel

The New Normal

CIGARETTE BRAND EXPECTATIONS

Which brand do you expect to gain the most market share in 2016?

JUNE ’15

SEPTEMBER ’15

MARCH ’15

Source: RBC Capitol Markets-CSP Tobacco Retailer Survey

30

TOBACCO BUSINESS INTERNATIONAL

JULY/AUGUST 2016

CATEGORY MANAGER

CIGARETTES AND E-CIGARETTES