Are reports of the death of the vapor store channel

greatly exaggerated? Some say that virtually all of the

country’s 8,000-plus vapor stores will fade away as the

FDA’s deeming regulations phase in. In fact, the FDA it-

self has reportedly predicted the demise of 90 percent of

the channel over the next few years—which may actually

be for the best, notes Norm Bour, founder of the vapor

consulting company VapeMentors.

“I don’t necessarily think that’s all bad, because the

reality is that most vapor shops are poorly run, with bad

customer service and bad management,” he says. “Also,

it’s not a commodity yet; it’s still a pretty unique product.

So this is not like a gas station where you need one on

every corner.”

Bour’s prediction? “Five years down the road, you’ll

walk into a store the size of a Walgreens and that’s where

you’ll go for your vice of choice—alcohol, tobacco,

CBD, cannabis. Everything will be highly taxed, but the

store will be run professionally.”

On the other end of the spectrum, advocates of the

relatively young vapor shop format are hopeful, if not

entirely confident, that a reprieve will deliver salvation at

the eleventh hour. “I’m optimistic,” says Schell Hammel,

founder of The Vapor Bar, who was an early pioneer

in the vapor shop arena and also works extensively with

SFATA as a vapor industry advocate. “We have legisla-

tion, lawsuits and advocates working around the clock—

there are a lot of things going at once. You don’t lose

hope until the very last day. You just can’t.”

EVOLUTION, NOT EXTINCTION

The big money, however, is somewhere in the middle—

betting on a winnowing out of the “opportunists” who

got into the game looking for a quick hit, coupled with

the need for those staying the course to adapt their busi-

nesses to the new reality.

“Realistically, the vapor store channel, which is

very fragmented, will continue to consolidate given the

regulation and the overhang,” agrees Bonnie Herzog,

managing director and tobacco analyst at Wells Fargo.

“Having said that, I think the stronger shops will con-

tinue to thrive.”

In fact, the retail field is already narrowing as vape shop

owners who profited handily by making their own e-liq-

uids come up against a harsh regulatory reality. “Supply-

ing your own liquid was where the big money was being

made at retail,” notes John Wiesehan, CEO of Ballantyne

Brands, who says the universe of vape shops has already

dropped from about 12,000 two years ago to the 8,000 fig-

ure commonly cited today. In the wake of deeming regu-

lations that are curtailing imports from China, those store

owners are now struggling to source e-liquids.

Barring a legal reprieve of some kind, survival will

require that most vape shops dramatically change both

what they sell and how they sell it—compromises that

vape owners who abhor anything Big Tobacco-related

may not be willing to make. “[If the deeming regulations

don’t get changed], you can survive by becoming strictly

retail and selling products made by Big Tobacco or by

“Retail has

transitioned to

a hybrid model

where selling

tobacco, smoke

and vape is

more prevalent

than vape-only

stores.”

—JOHN WIESEHAN,

CEO, BALLANTYNE

BRANDS.

➨

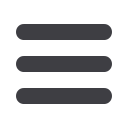

Vape shops that thrived by making and

selling their own e-liquids will need to

change their business models or face being

regulated as manufacturers by the FDA.

[ 58 ]

TOBACCO BUSINESS

[

MARCH

/

APRIL

|

17 ]