WELCOME TO THE NEW

THE OFFICIAL MAGAZINE OF PHILLIPS & KING

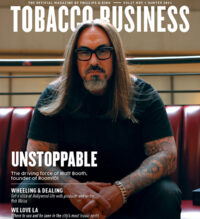

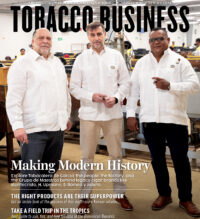

Welcome to Tobacco Business Magazine, exclusively available to Phillips & King customers. Full of content that celebrates the stories of the people, places, and products behind our industry, Tobacco Business Magazine now features a strong retailer focus, offering insights, behind-the-scenes stories, and best practices that will better support your business. Become a Phillips & King customer and receive your copy of Tobacco Business Magazine 4 times a year- for FREE!