38

TOBACCO BUSINESS

MARCH/APRIL 2014

CATEGORY MANAGER

retail trends

T

he times, they are a’changing. Many of the shifts

taking place in the tobacco retail landscape are, by

now, expected by the industry. Few, for example,

will be shocked to hear that tobacco volume decreased by 2

percent in 2012, according to U.S. Tobacco Trends, a February

2014 report by Bonnie Herzog, managing director of tobacco,

beverage and convenience store research for Wells Fargo

Securities. But not all categories of tobacco suffered a decline.

While cigarette volume was down 5 percent, smokeless

tobacco volume increased by 5 percent.

As many in the industry have anticipated, cigarette sales

continued to drop in 2013, while e-cigarette sales continued

to grow—reaching approximately $2 billion for the year.

“The majority of respondents from our Tobacco Talk survey

continue to be very excited about the e-cig category,” writes

Herzog. “We think consumption of e-cigarettes could outpace

combustible cigarettes over the next decade.” Blu, NJOY and

Logic have emerged as early market leaders, adds Herzog,

who also notes that while the Big Three tobacco players are

now in the category and some consolidation is likely, research

suggests that brands like NJOY, Mistic, Fin, Logic and Krave

will continue to enjoy a healthy position in the market.

“We think that e-cigs are to tobacco what energy drinks

are to beverages—highly profitable and quickly growing in

volume and shelf space at retail, and increasingly gaining

customer acceptance,” writes Herzog.

As the various tobacco companies continue to grapple for

market share, retailers are also jockeying for position in the

category. Family Dollar and Dollar General have begun selling

cigarettes, suggesting that dollar store chainsmay be a growth

channel for the category. Vape stores are another emerging

retail trend, although many question their long-term viability,

contending that the FDA may regulate them out of existence.

Meanwhile, CVS opted to abdicate, exiting the tobacco sales—

which accounted for an impressive $2 billion in sales for the

company—altogether.

To follow are some charts excerpted from the report that

offer a snapshot of current retail trends.

TB

Tobacco by the Numbers

Highlights from Bonnie Herzog’s U.S. Tobacco Trends report

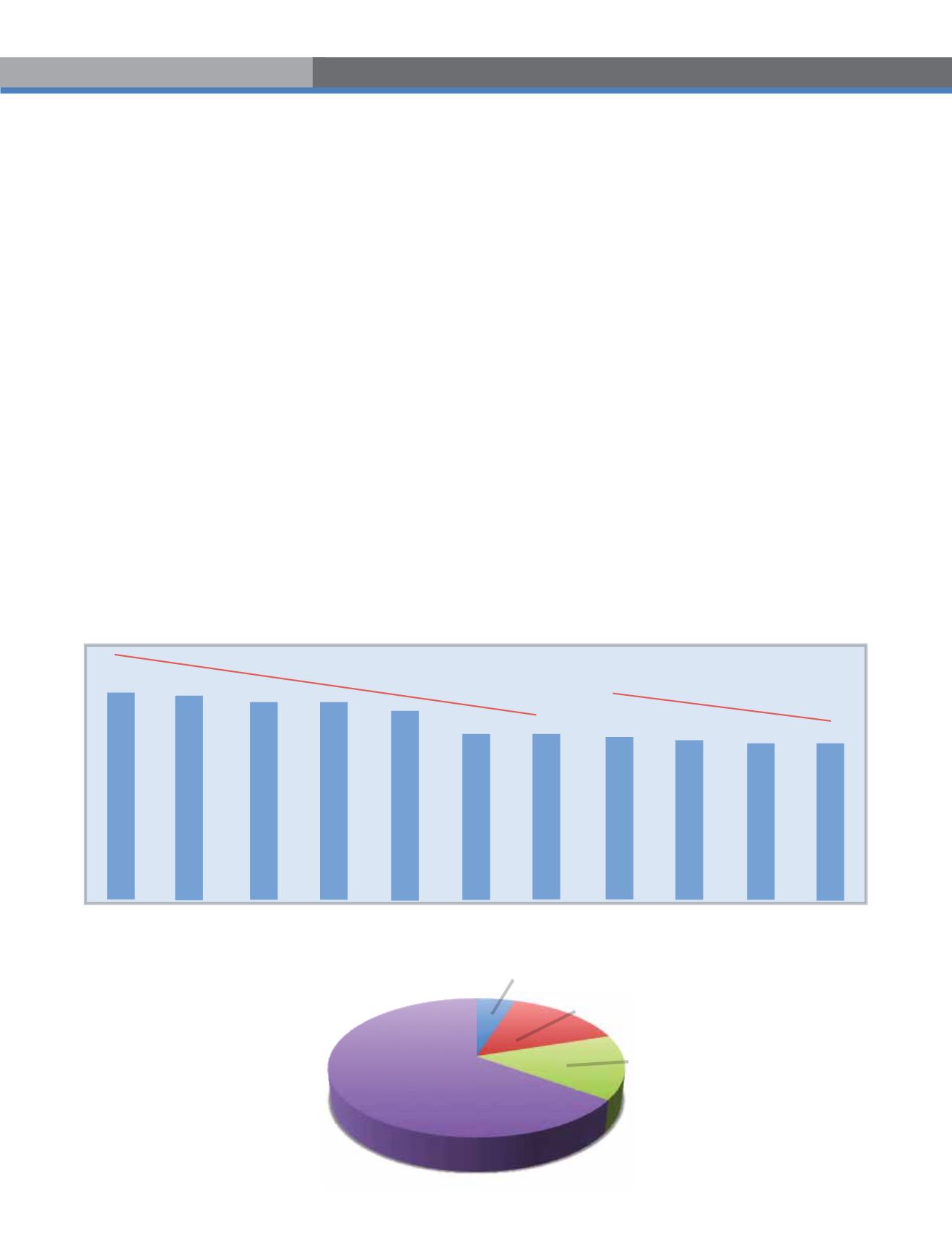

Total Tobacco Estimate

Total tobacco volume decreased by 2% in 2012. Cigarette volume was down 5% and smokeless tobacco volume increased by 5%.

FY2003 FY2004 FY2005 FY2006 FY2007 FY2008 FY2009 FY2010 FY2011 FY2012 FY2013E*

1200

1,000

800

600

400

200

0

Volume (in millions of pounds)

Total Tobacco Industry Volume (in millions of pounds)

5-Yr CAGR=1.0%

4-Yr CAGR=1.5%

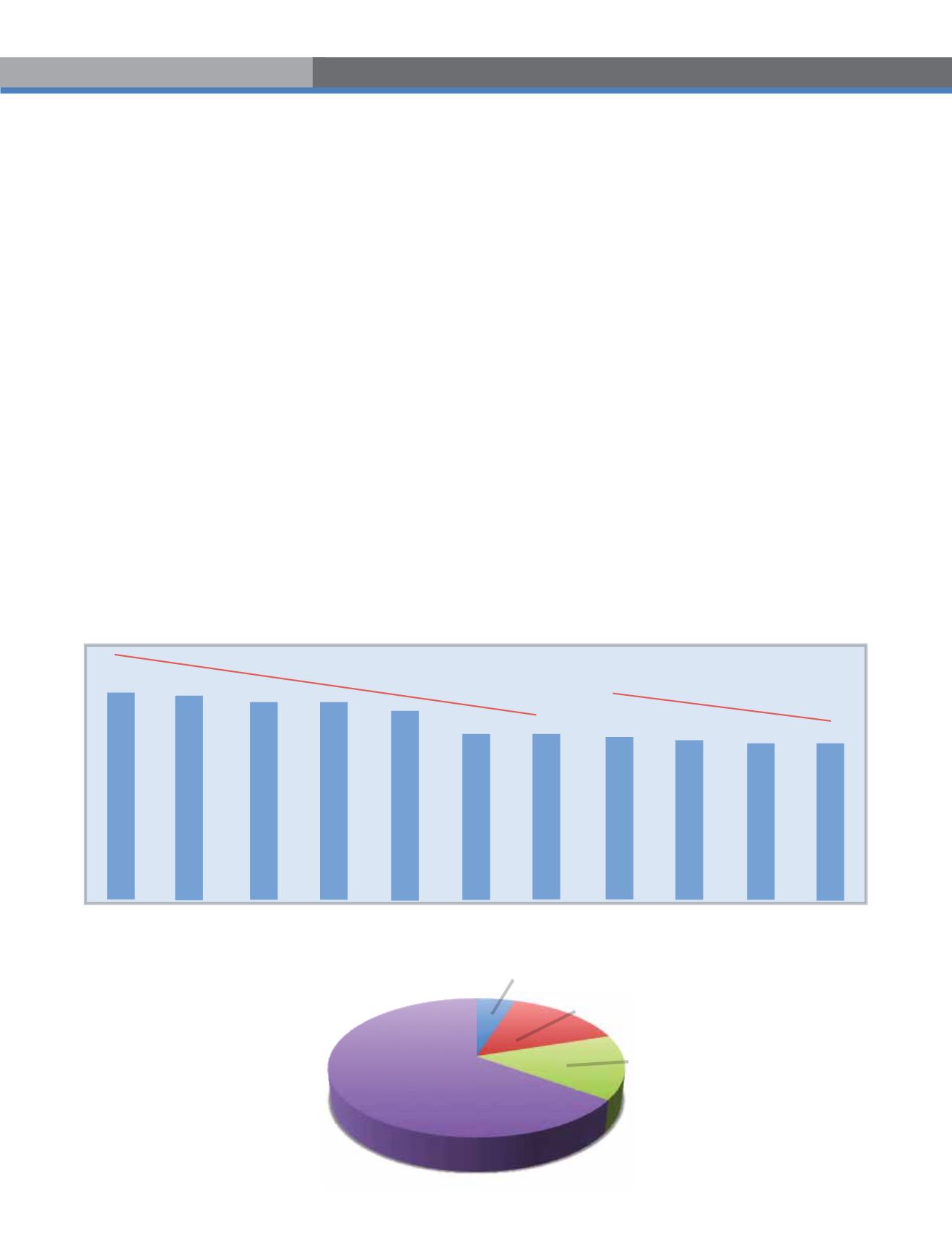

Retail Channel Market Share

C-stores still top the tobacco distribution chain.

C-stores continue to account for the bulk of

tobacco sales, and are also the dominant player

in the e-cigarette category.

*Estimated

C-Stores

Mass & Others

Tobacco Stores

Grocery & Drug