28

TOBACCO BUSINESS INTERNATIONAL

SEPTEMBER/OCTOBER 2014

CATEGORY MANAGER

PIPE TOBACCO

F

irst the good news: in the last five years, pipe tobacco

has enjoyed a relatively great run—particularly when

compared to other struggling categories of traditional

tobacco. Now the bad news: that run-up is largely—if not

entirely—attributable to the tax implications of the Children’s

Health Insurance Reauthorization Act (SCHIP) legislation

passed in 2009.

In fact, a2012 report by theU.S.GovernmentAccountability

Office (GAO) found that monthly sales of pipe tobacco

increased from about 240,000 pounds in January 2009 to

more than three million pounds in September 2011, while

monthly sales of roll-your-own tobacco decreased from

approximately two million pounds to 315,000 pounds in the

same time frame.

By raising the federal excise tax on roll-your-own tobacco

from$1.09 a pound to $24.78 literally overnight, SCHIPmight

The Problem With Pipe Tobacco

The controversy continues over how to handle

the pipe-tobacco-as-RYO issue.

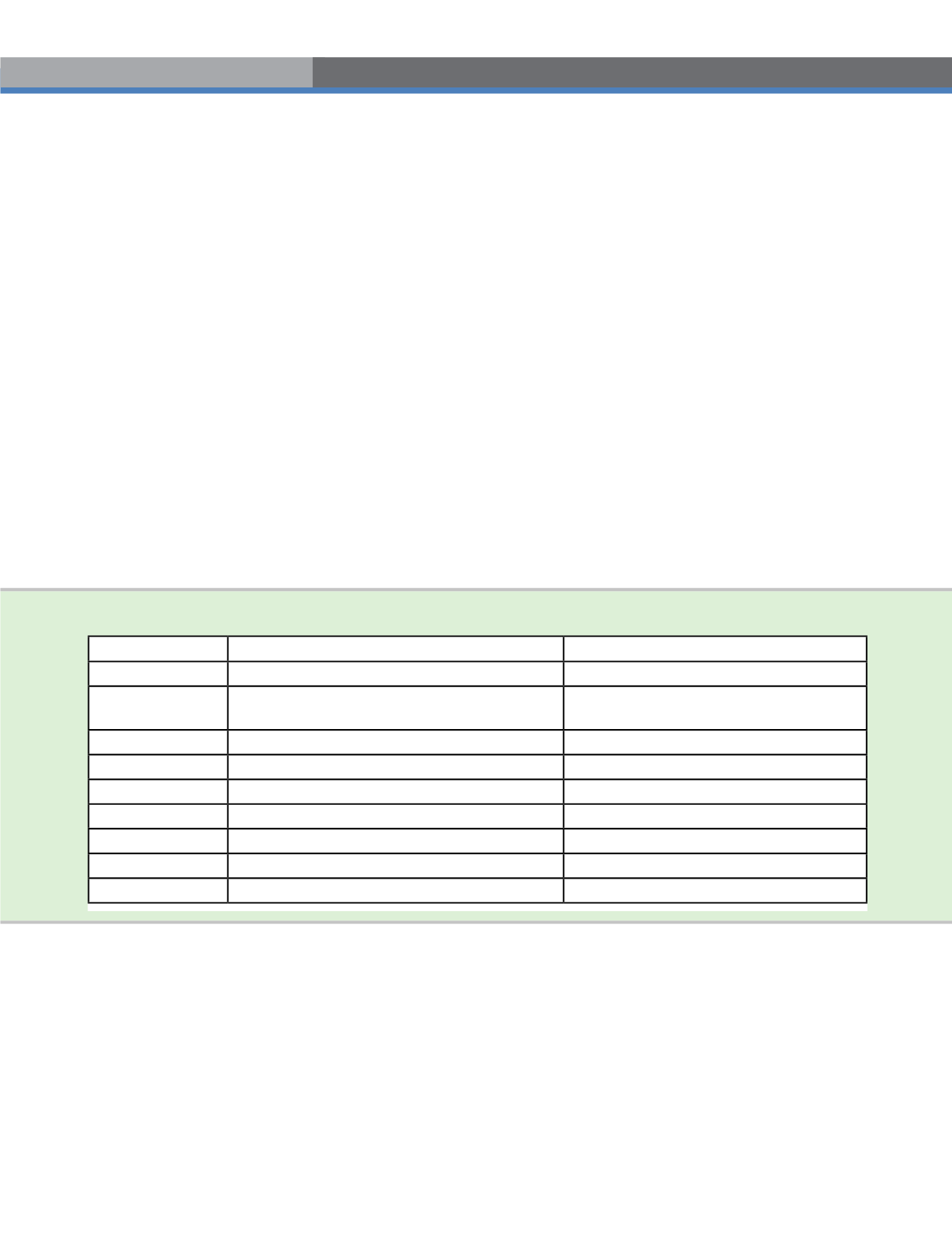

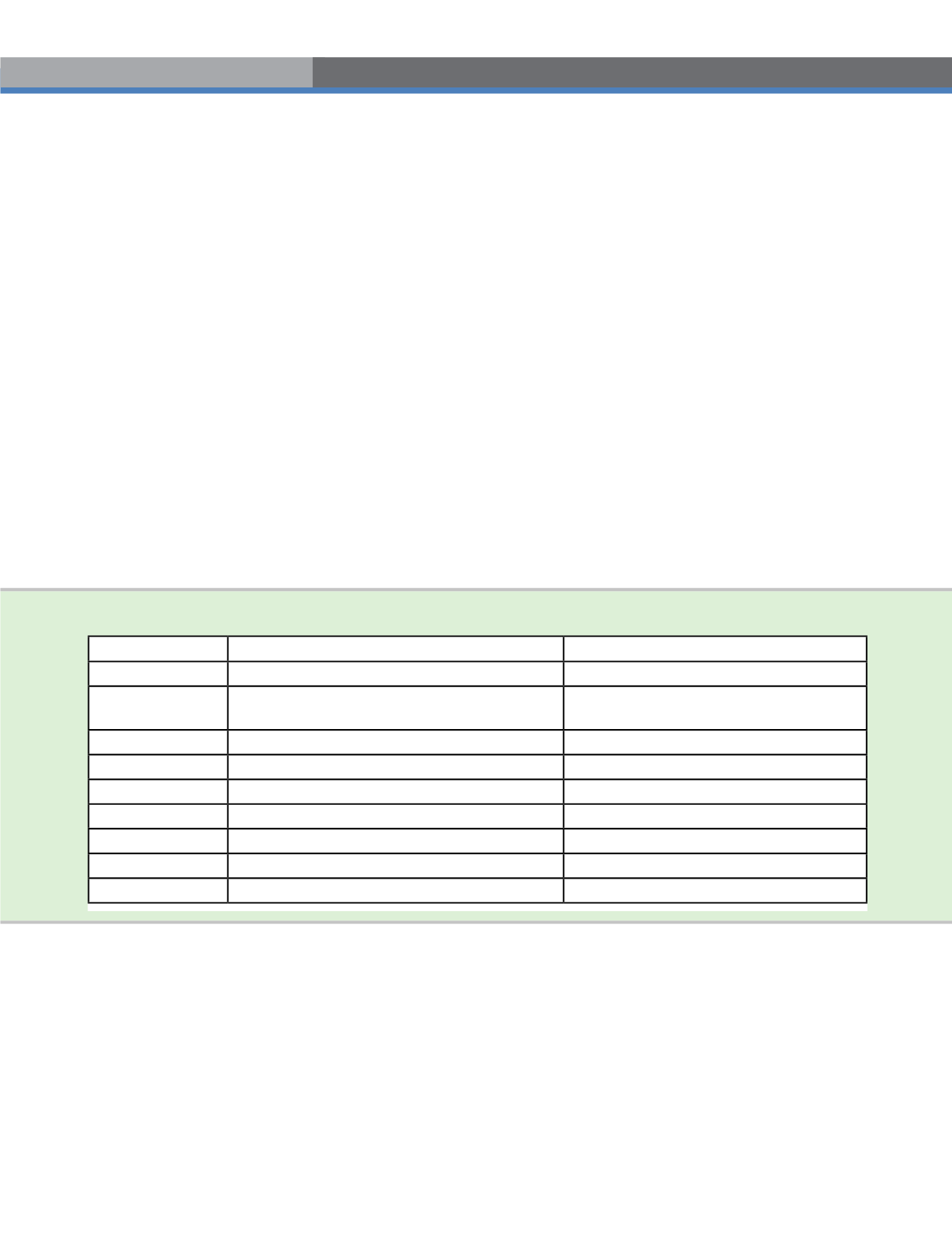

Product

Federal Tax Rates Through March 31, 2009

Federal Tax Rates on April 1, 2009

Cigarettes

39¢/pack

$1.0066 per pack (rounded to $1.01/pack)

Large Cigars

20.719% of manufacturer’s price;

cap of 4.875¢/cigar

52.75% of manufacturer’s price;

cap of 40.26¢ per cigar

Little Cigars

4¢/pack

$1.0066/pack (rounded to $1.01/pack)

Pipe Tobacco

$1.0969/pound

$2.8311/pound

Chewing Tobacco

19.5¢/pound

50.33¢/pound

Snuff

58.5¢/pound

$1.51/pound

RYO; Cigar Wrappers

$1.0969/pound

$24.78/pound

Cigarette Paper

1.22¢/50 papers

$3.15¢/50 papers

Cigarette Tubes

2.44¢/50 tubes

6.30¢/50 tubes

Taxes Before and After SCHIP

well have sounded the death knell for the RYO category.

However, as everyone knows, a workaround soon emerged

in the form of bagged pipe tobacco, which RYO customers

soon began using in lieu of RYO tobacco.

Of course, this practice—labeled by many as a loophole—

has increasingly come under fire. “Public health officials

have raised concerns that some pipe tobacco might be

masquerading as RYO,” Daniel McGee of Scandinavian

Tobacco Group told attendees of the Tobacco Merchants

Association’s annual meeting earlier this year. “What it

comes down to is that pipe tobacco is not specifically

defined; it’s basically about what label the manufacturer

puts on the bag, or the manufacturer’s intent.”

McGee and others in the pipe tobacco category are

concerned that, in an effort to close the pipe-tobacco-as-

RYO loophole, regulators will simply tax pipe tobacco at the

Source: GAO